The Rail Freight Value-Driving Supply Chain

Supplier and supply chain management are means by which cost-reducing efficiencies can be obtained and profits thereby increased. DB customers want to minimize logistical costs in order to maximize returns from the sale of freight. For the manufacturing customer, movement of goods to consumer or retailer/distribution centre constitutes “outbound logistics”, usually the final physical distribution stage for which the manufacturer is responsible. The provider decision is usually the responsibility of a supply chain or logistics managers (in some companies, transport is often purchased by generalist procurement personnel). Supply chain-aware managers will prioritize capability rich, known-good providers, ideally with robust supply chains of their own.

Effective supply chain management supports marketing and sales by offering competitor-beating, order-winning capabilities. For DB, converting cost reductions obtained by improved supplier management to lower prices could prove fruitful. The customer’s procurement department will understand the hazards of buying on price so will favour business with partners who operate strong, quality-focussed, integrated supply chains.

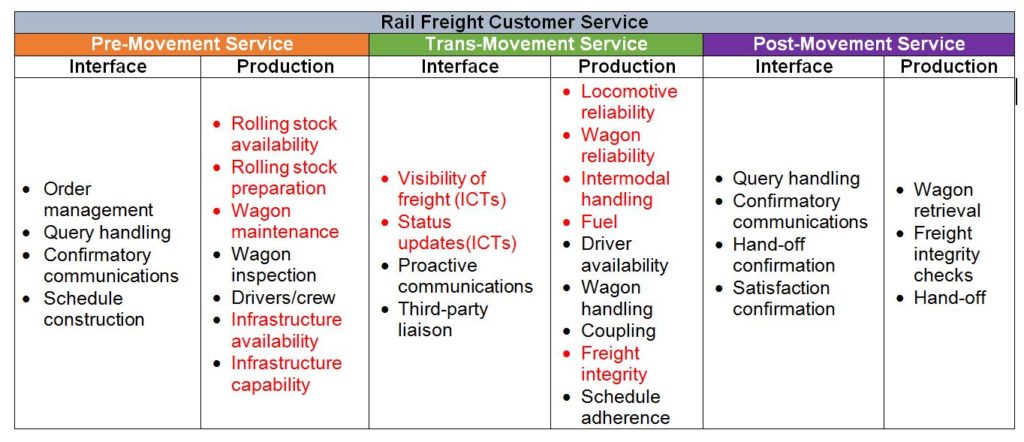

In the following table, red text identifies the value-adding activities that are supplier-dependent. In service businesses such as transport, the “product” is the service provision. Consequently “Production” denotes the activities that constitute the creation of that service, i.e. the tangible manifestation of the firm’s offering. In the case of DB specifically, “Production” describes the operations entailed in the provision of rail freight carriage: the allocation of a locomotive and driver, the delivery or collection of wagons, and the transport of those wagons to the customer’s specified delivery point.

Supply Chain-Related Activities in the Rail Freight Customer Service Trinity

Since DB is not a manufacturer but provides a product in the form of transport, the firm procures the materials and equipment it requires to perform its operations. Rolling stock, infrastructure (facilities), and ICTs (including RFID and GPS systems) represent major investments. The relationships DB has with the suppliers of these operationally central components determine the prices it will pay and the level of service efficiency delivered by the supplier. The more efficient that service, the better the price and performance of the product. Put succinctly, the supply chain in which entities are closely interconnected creates system-wide capability gains that can be transferred to the customer. These gains can be converted into saleable benefits that marketing and sales can present to customers. Supply chain transparency implies quality control, which, in turn, implies mechanical reliability. Such strengths must be fully harnessed.

Some services support others: installation of equipment and infrastructure, management of reverse logistics, ICTs, and GPS/RFID tagging of wagons and tractions. Invisible to the customer are other supporting activities, such as the procurement of goods and services and the management of suppliers. These latter two activities lack immediate relevance to customers, but can be promoted by marketing to customers who want to understand the wider DB system, require performance reassurances, or wish to create partnerships with companies who are supply chain focussed. In the event of performance and price equivalence, DB SR’s supply chain strengths can be emphasized. CSR-conscious companies may also wish to demonstrate transparency and benefit from allegiance with partners who have strong supply chain credentials. Seen in this light, the supply chain functions as a competitive weapon.