Disaggregating Customer Value in Rail Freight Logistics

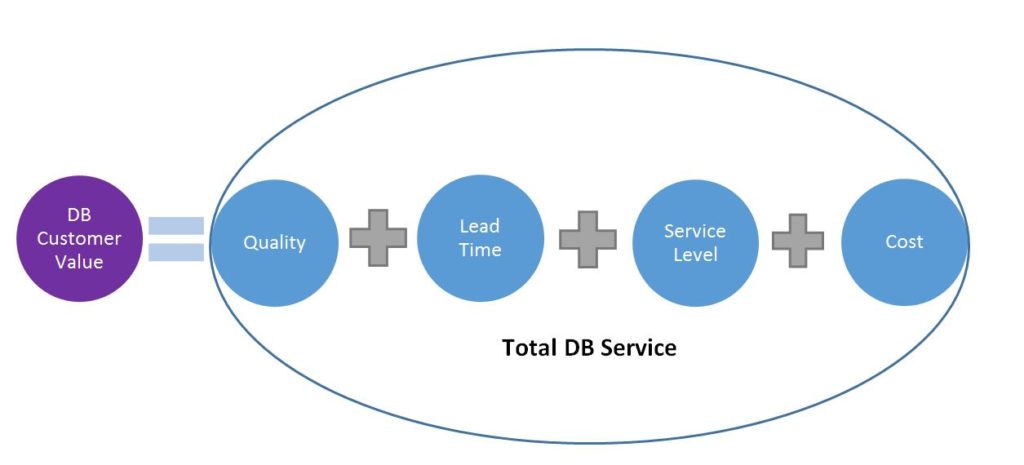

The following figure illustrates the four constitutive elements of value obtained by customers engaging with DB.

Quality

“Quality” is a variously interpretable, somewhat overused and overextended term. In manufacturing and operations management generally, and service industries specifically, quality is defined by the customer. Performance quality expectations are usually formally encoded in key performance indicators (KPIs) or Service Level Agreements (SLAs) that DB will accept or reject prior to commitment. Normally, KPIs enforce performance conditions on service providers, so are of extreme importance to all parties. Failure to meet a KPI, such as 90% OTIF (“on time, in full”) would result in compensatory remuneration or, if persistent, discontinuation of contract. As already mentioned, if competitors can meet quality requirements while offering attractive prices to their customers, and if contractual conditions are comparable between competitors, quality of service beyond basic requirement will acquire significance. The railfreight provider that is capable of providing service quality that meets or exceeds customer requirement has greater order-winning potential when no other differentiating provisions exist.

Lead Time

This term refers to the length of time that elapses between customer’s placement of orders and their receipt of the goods ordered. In B2B situations, lead times are more predictable. As a general rule, the further goods are from consumer pull and the more commodity-like their nature, the more predictable the demand, the more routine the supply, and the more steady-state the supply chain overall. Since railfreight is more suited to high bulk/weight materials in large volumes than to highly mixed, handball loads, responsiveness is not quite the value-driver that it is with road – a modality whose flexibility is supportive of the more ad hoc demand/pull patterns that typify B2C activity.

The foregoing notwithstanding, dependability in lead time (rather than flexibility, which is more critical in B2C trading), allows the customer to schedule production with greater certainty. The customer will also be trying to compress the cash-to-cash cycle. Lead times that are certain, even if not significantly shorter than competitors’, will be attractive enticements.

Cost

From the customer’s viewpoint, “cost” is the amount paid to DB SR for the movement of freight by rail, i.e. the “price” charged by DB SR. (For DB SR, “cost” is the capital expended in the provision of that movement.)

In railfreight, where providers are scarce compared to road, price variance between competing providers is limited. Hence customers will expect similar prices from competing businesses. If we assume that DB SR’s pricing is comparable with that of its competitors, the other three factors point toward order-winning, value-driving activities. However, for DB SR, separating cost from the other three factors yields little merit – cost is a complex composite, influenced by the service level expectation: the higher the service required, the higher the costs incurred, the higher the price offered. Although cost and price are to a large extent interlocked, it is cost as perceived by the customer that is important when deconstructing value in the Total DB service provision.

Although customers seek to minimize costs in order to maximise profits (so rationally seek lower prices), the ramifications of a risk-enlarging, service quality-degrading race to the bottom make price-decisions rare. Recent trends in procurement practice emphasize awareness of the mutual advantages of long-term buyer-seller relationships, concerns with “quality”, and the growing ubiquity of bundled services made possible by closer buyer-seller interaction. Cost will however remain influential. In the event of capability equivalence between DB and its competitors, buyers will likely differentiate on other factors, price being one such factor.

Service Levels

In railfreight contracts, service levels are practically inseparable from quality: service level agreements (SLAs) can be coded variously, as KPIs or other forms of formal agreement (contractual terms of trade). Formal regulations cover movement of freight by rail. The highly regulated nature of rail systems imposes minimum quality, safety, and security conditions that ensure a degree of substitutability in the railfreight market. For this reason, competitive advantage-generating differentiation is rooted in service level operations and intermediating operations such as those that facilitate the customer service interface. Examples of concepts that are likely expressed in SLAs are “right first time” and “on-time, in-full” (OTIF), and “error free”. SLAs force the customer to provide sets of explicitly stated requirements, around which the provider can build a service that meets, or ideally exceeds, those requirements.

Together, quality, lead time, service level requirements, and cost form the four components of value as perceived by the railfreight customer. The challenge for DB SR is to surpass its competitors on all four components. Supplier relationships influence cost, lead time, and quality directly, and service level indirectly. A supply chain-emphatic approach is therefore prudent. The strong overlaps between the four components suggest that the reinforcement of one component is likely to benefit the others. In the next section, Table 2 identifies which activities are likely to gain most from strong cooperation between DB and its suppliers.

To be considered at this point is the possibility of improving the DB proposition by wringing out economies from supply chain management. DB stands to gain competitive advantage if supply chain strengths can be concentrated on value-adding activities particularly.